INTRODUCTION #

Purpose of Document #

The purpose of this document is to specify how to extend payment options to use (NOTIFICATION SERVICES) to e-commerce customers in a few simple steps.

Glossary #

HMAC: Hash-based Message Authentication Code – AKA keyed-hash message authentication code, is a specific type of message authentication code (MAC) involving a cryptographic hash function and a secret cryptographic key. It may be used to simultaneously verify both the data integrity and the authentication of a message, as with any MAC.

NOTIFICATION SERVICES #

What is Notification Services #

Notification Services allow merchants to receive notifications whenever a transaction is generated for their accounts. In order to receive notifications from this service, you will need to implement a restful API service according to the specifications in this document.

Supported channels:

- International card schemes – Visa and Mastercard

- Mobile Wallet schemes – TAHWEEL

- Digital payment scheme – mVisa

Checklist #

In order to enable the NOTIFICATION SERVICES you will need the following:

- Merchant should have Merchant ID assigned

- Merchant should have at least one “web terminal” and Terminal ID assigned to allow card acceptance

In order to receive transaction notifications, you need to implement a restful service according to below specs:

Request Message Formats

| Message Item | Data Type | Min-Max

Length |

Optional/

Mandatory |

Comments |

| MerchantId | String | 1-18 | M | The merchant ID |

| TerminalId | string | 1-8 | M | The terminal ID defined to use APIs |

| SecureHash | String | 20-250 | M | A keyed hash message authorization code (HMAC) is a specific type of message authorization code (MAC) involving a cryptographic hash function and a secret cryptographic key. It is used to verify both the data integrity and the authorization of a message.

For more information on how to generate and verify secure hash read appendix A |

| DateTimeLocalTrxn | String | 12-12 | M | The transaction execution date and time with format” yyyyMMddHHmmss” |

| Message | String | 0-250 | M | The message describes the transaction initiation status |

| TxnType | Integer | 1-5 | M | Identifies transaction type:

1: Sale 2: Refund 3: Void Sale 4: Void Refund |

| PaidThrough | String | 1-50 | M | The source of transaction execution (Card, Wallet, etc…) |

| SystemReference | String | 1-14 | M | PaySky gateway Reference number |

| NetwrokReference | String | 0-32 | O | Tahweel reference number in case of a tahweel transaction. mVisa reference in case of mVisa Transaction |

| MerchantReference | String | 0-300 | O | Merchant Reference for this transaction, TLV |

| Amount | String | 1-15 | M | The original transaction amount in smallest currency units |

| Currency | String | 3-3 | M | The Transaction Currency shall conform to [ISO 4217] and shall contain the 3-digit numeric representation of the currency. For example, EGP is represented by the value “818”. |

| PayerAccount | String | 10-100 | M | The customer account used for the transaction, for card transactions it’s the masked card number |

| PayerName | String | 0-100 | O | The customer name used for the transaction |

| ActionCode | String | 0-3 | O | The payment gateway action code. For complete list please check appendix B

“00”: transaction approved |

| SID | String | 0-200 | O | Terminal SID |

| Token | String | 0-200 | O | Terminal Token |

Request Example

Response Message Formats

| Message Item | Data Type | Min-Max

Length |

Optional/

Mandatory |

Comments |

| Message | String | 0-250 | M | The message describes the transaction initiation status |

| Success | Boolean | 4-4 | M | True, if the transaction initiated successfully |

Response Example

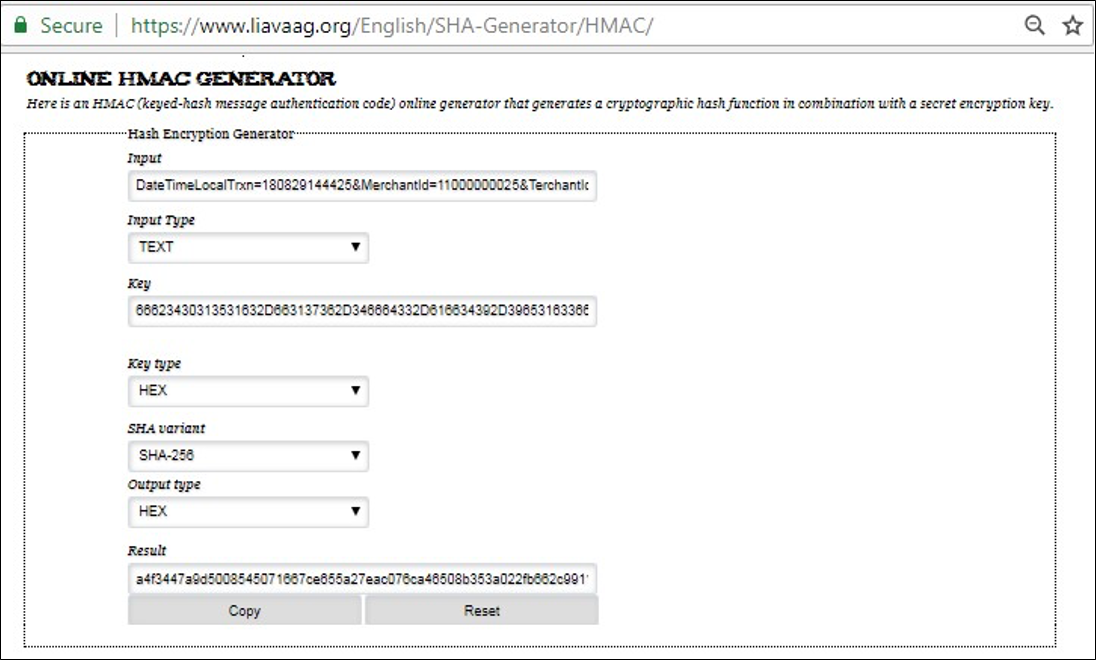

Appendix A: APIs Secure hash generation #

- Request data to be hashed:

- DateTimeLocalTrxn

- MerchantId

- TerminalId

- Amount

- Currency

- Merchant SecretKey to be provided by the merchant, should be hex decimal string with max 100 chars

- The SHA-256 HMAC is calculated as follows:

- The SHA-256 HMAC calculation includes all fields listed above.

- The field names are sorted in ascending of parameter name as listed above.

- Construct a string by concatenating the string form of the sorted field name-value pairs. The string form of a name-value pair is the name followed by the value.

- The field name and the value in each field name-value pair are joined using “=” as the separator.

- The resulting joined field name-value pairs are themselves joined using “&” as the separator.

- Create a SHA-256 HMAC of the resultant string using the hex decoded value of merchant secret key given by PAYSKY integration consultant as the key.

- Encode the HMAC in hexadecimal and convert it to uppercase, then compare it with SecureHash field at the request it should be the same and any other values indicates unauthorized notification request.

Example:

use the following URL: https://www.liavaag.org/English/SHA–Generator/HMAC/ with correct parameters are set:

Appendix B: Transaction Response Codes #

| Code | Meaning |

| 00 | Successful approval/completion or that VIP PIN verification is valid |

| 01 | Refer to card issuer |

| 02 | Refer to card issuer, special condition |

| 03 | Invalid merchant or service provider |

| 04 | Pickup |

| 05 | Do not honor |

| 06 | General error |

| 07 | Pick up card, special condition (other than lost/stolen card) |

| 08 | Honor with identification |

| 09 | Request in progress |

| 10 | Partial approval |

| 11 | VIP approval |

| 12 | Invalid transaction |

| 13 | Invalid amount (currency conversion field overflow) or amount exceeds maximum for card program |

| 14 | Invalid account number (no such number) |

| 15 | No such issuer |

| 16 | Insufficient funds |

| 17 | Customer cancellation |

| 19 | Re-enter transaction |

| 20 | Invalid response |

| 21 | No action taken (unable to back out prior transaction) |

| 22 | Suspected Malfunction |

| 25 | Unable to locate record in file, or account number is missing from the inquiry |

| 28 | File is temporarily unavailable |

| 30 | at error |

| 41 | Merchant should retain card (card reported lost) |

| 43 | Merchant should retain card (card reported stolen) |

| 51 | Insufficient funds |

| 52 | No checking account |

| 53 | No savings account |

| 54 | Expired card |

| 55 | Incorrect PIN |

| 57 | Transaction not permitted to cardholder |

| 58 | Transaction not allowed at terminal |

| 59 | Suspected fraud |

| 61 | Activity amount limit exceeded |

| 62 | Restricted card (for example, in country exclusion table) |

| 63 | Security violation |

| 65 | Activity count limit exceeded |

| 68 | Response received too late |

| 75 | Allowable number of PIN-entry tries exceeded |

| 76 | Unable to locate previous message (no match on retrieval reference number) |

| 77 | Previous message located for a repeat or reversal, but repeat or reversal data are inconsistent with original message |

| 78 | ’Blocked, first used’—The transaction is from a new cardholder, and the card has not been properly unblocked. |

| 80 | Visa transactions: credit issuer unavailable. Private label and check acceptance: Invalid date |

| 81 | PIN cryptographic error found (error found by VIC security module during PIN decryption) |

| 82 | Negative CAM, dCVV, iCVV, or CVV results |

| 83 | Unable to verify PIN |

| 85 | No reason to decline a request for account number verification, address verification, CVV2 verification; or a credit voucher or merchandise return |

| 91 | Issuer unavailable or switch inoperative (STIP not applicable or available for this transaction) |

| 92 | Destination cannot be found for routing |

| 93 | Transaction cannot be completed, violation of law |

| 94 | Duplicate transmission |

| 95 | Reconcile error |

| 96 | System malfunction, System malfunction or certain field error conditions |

| B1 | Surcharge amount not permitted on Visa cards (U.S. acquirers only) |

| N0 | Force STIP |

| N3 | Cash service not available |

| N4 | Cashback request exceeds issuer limit |

| N7 | Decline for CVV2 failure |

| P2 | Invalid biller ination |

| P5 | PIN change/unblock request declined |

| P6 | Unsafe PIN |

| Q1 | Card authentication failed |

| R0 | Stop payment order |

| R1 | Revocation of authorization order |

| R3 | Revocation of all authorizations order |

| XA | Forward to issuer |

| XD | Forward to issuer |

| Z3 | Unable to go online |